Calendar Call Spread Option Strategy - Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit], Calculate potential profit, max loss, chance of profit, and more for calendar call spread options and over 50 more strategies. A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but. Glossary Archive Tackle Trading, Option trading strategies offer traders and investors the opportunity to profit in ways not available to. Definition and how strategy works in trade.

Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit], Calculate potential profit, max loss, chance of profit, and more for calendar call spread options and over 50 more strategies. A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but.

With calendar spreads, you can set a stop loss based on percentage of the capital at risk.

Calendar Spread Options Trading Strategy In Python, You may trade two calls or two puts, but each is the same type. In a nutshell, a calendar options spread involves.

Trading Calendar Spreads Learn the Strategy, Roll De… Ticker Tape, Calculate potential profit, max loss, chance of profit, and more for calendar call spread options and over 50 more strategies. With calendar spreads, you can set a stop loss based on percentage of the capital at risk.

You may trade two calls or two puts, but each is the same type.

Long Calendar Spreads Unofficed, In a nutshell, a calendar options spread involves. To utilize a calendar spread strategy, you buy and sell two options.

A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but.

Calendar Call Option Spread [SPX] YouTube, To utilize a calendar spread strategy, you buy and sell two options. Options on the buy and sell side are.

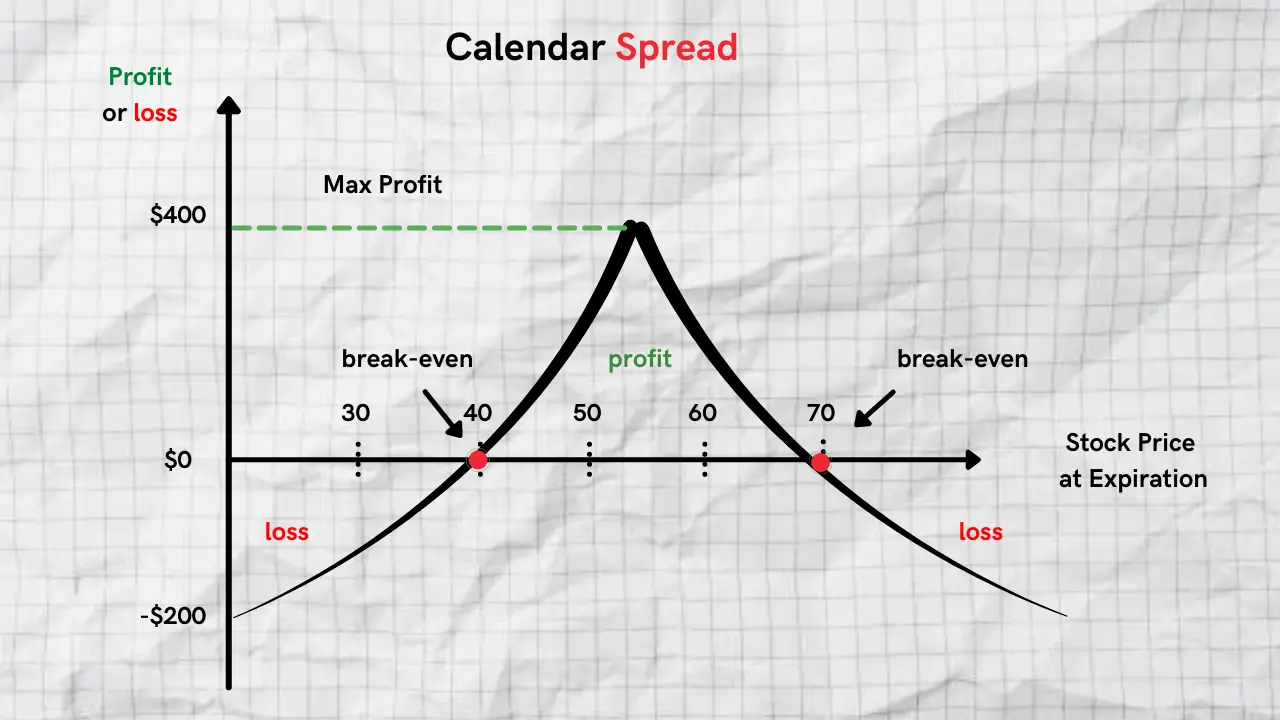

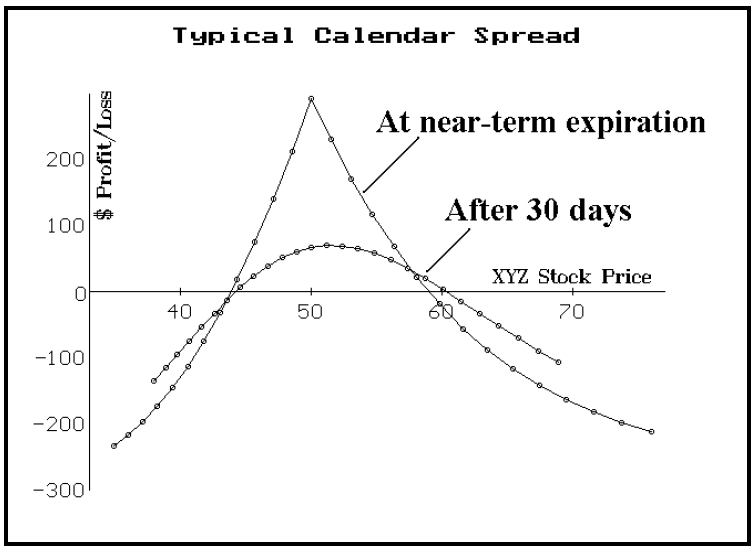

Calendar Spread Explained InvestingFuse, That is, for every net debit of $1 at initiation, you’re hoping to receive $2 when closing the. The calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying points in.

Trading Guide on Calendar Call Spread AALAP, The calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security doesn't move, or only moves a little. That is, for every net debit of $1 at initiation, you’re hoping to receive $2 when closing the.

Additionally, you use the same strike price for both. Both call options will have the same strike price.